Question 2: On 01.10.2016, X purchased 5 Machines from Y for ₹ 10,00,000. Payment was to be made—20% down and the balance in

four annual equal instalments of ₹ 2,50,000 each to be paid at the end of each year. X, writes off depreciation @ 20% p.a. on the

original cost. On X ’s failure to pay the third instalment, Y e-mailed X that on 01.04.2020 he will repossess 3 machines and will

allow a credit for lower of the following:

(i) Value of Machines on the basis of 40% p.a. depreciation on WDV basis.

(ii) the amount paid against 3 machines less 50%.

X replied Ok. 01.04.2020 Y repossessed the machines as per mail.Y spent ₹ 6,000 on repairs of these machines and sold one of

such machines for ₹ 70,000 on 30th June 2020. X follows financial year as its accounting year.

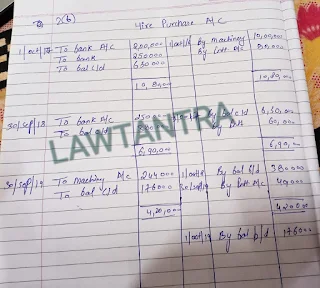

Required: Prepare Machinery Account and Hire Vendor’s Account in the books of X and Hire Purchaser’s Account and Goods

Repossessed Account in the books of Y. Also Show the Items related to Hire Purchase in the Balance Sheet of X as at 31st

March, 2020.

Answer:

Answer:

Some Useful Links:

- Sol DU online exams from March 15, 4 Important questions

- farmer-protest-live-updates

- CAT2020: Read these important things before going to the exam hall

- Modi government gave big relief, Small Business

- New farm laws and conflict between Govt. & Farmers

- Struggle in Drafting Constitution

- Defamation and IT Act

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

If any Photos/Videos/Article/Blog/Content has an issue with this upload, please contact us and we will remove it immediately. Contact E-Mail : lawtantra@gmail.com

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

1 Comments

Hlo sir ye answer 2 aapne pura upload kiya h aur isme machinery account nhi banega kya?

ReplyDeletePlease do not enter any spam link in the comment box.